pay utah withholding tax online

This must be completed for OnPay to be able to file and pay your Utah taxes. Cookies are required to use this site.

Kiplinger Tax Map Retirement Tax Income Tax

Please contact us at 801-297-2200 or taxmasterutahgov for more information.

. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States. For security reasons TAP and other e-services are not available in most countries outside the United States. You can pay taxes online using the EFTPS payment system.

The information you give your employer on Form W4. The amount of income tax your employer withholds from your regular pay depends on two things. Utah Taxpayer Access Point TAP TAP.

Form TC-941D Discrepancy Report for Annual Withholding Reconciliation is due by January 31st each year to report on the prior calendar year and must be filed online. Utah Payroll Tax Resources. You may use this Web site and our voice response system 18005553453 interchangeably to make payments.

You have been successfully. Enter Personal Information a First name and middle initial. Your browser appears to have cookies disabled.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. If you pay Utah wages to Utah employees you must have a Withholding Tax license.

Workers Compensation Coverage administered by the Utah Labor Commission. Go to Your Account Make a Guest Payment from Your Bank Account For individuals only. Existing employers can find their Withholding Tax Account Number on Form A-1 Return of Income Withheld.

Withholding Tax Account Number. Unemployment tax payment can be completed on Unemployment Insurance and New Hire Reporting web site httpsjobsutahgovuiemployeremployerhomeaspx without signing in. Online at through a bank debit e-check or a credit card ortaxexpressutahgov By sending your check or money order payable to the Utah State Tax Commission along with the coupon below to.

Unemployment Insurance administered by the Utah Department of Workforce Services. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows.

Follow the instructions at taputahgov. Utah has a very simple income tax system with just a single flat rate. More details about employment tax due dates can be found here.

Employer Withholding Tax - Missouri top dormogov. Filing Paying Your Taxes. Overview of Utah Taxes.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. Employment Taxes and Fees. Online payments may include a service fee.

Supplemental pay is an additional amount to regular pay separately stated and includes but is not limited. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full. You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax.

Of course Utah taxpayers also have to pay federal income taxes. Form TC-941PC Payment Coupon for Utah Withholding Tax is due monthly quarterly or annually based on the assigned payment schedule. Your withholding is subject to review by the IRS.

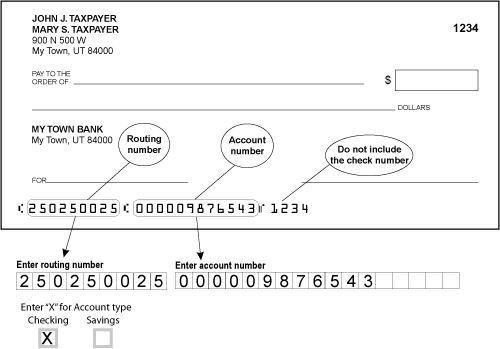

Utahs Taxpayer Access Point. WithholdingTax Payment Instructions You may pay your Utah withholding tax. Utah State Tax Commission 210 N 1950 W SLC UT 84134-0100 Payment Coupon for Utah Withholding Tax.

Register with the Utah State Tax Commission. If you are required to make deposits electronically but do not wish to use the EFTPS. According to Internal Revenue Regulations supplemental pay tax withholding may be calculated by applying the employees withholding rate from the Form W-4 on file or utilizing the flat rate withholding method currently 28 federal plus 6 for Utah.

You may also need. You may also pay with an electronic funds transfer by ACH credit. The withholding is based on the employees wages during that pay period and number of dependents.

For help with your withholding you may use the Tax Withholding Estimator. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Return to Tax Listing.

Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with your return. Give Form W-4 to your employer. Pay Online You may pay your tax online with your credit card or with an electronic check ACH debit.

Just in case you want to learn even more about Utah payroll taxes here are a few helpful. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. You may prepay through withholding W-2 TC-675R 1099-R etc payments applied from previous year refunds credits and credit carryovers or payments made by the tax due date using form TC-546 Individual Income Tax Prepayment Coupon or at taputahgov.

No cities in the Beehive State have local income taxes. Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Pay Now with Direct Pay Pay by Debit Card Credit Card or Digital Wallet eg PayPal For individuals and businesses not for payroll tax deposits. It does not contain all tax laws or rules.

On the bottom left hand side of the page find the Payments box and select Make a. The amount you earn. Ad Fill Sign Email TC-941 More Fillable Forms Register and Subscribe Now.

You can also pay online and avoid the hassles of mailing in a check. Utah Taxpayer Access Point TAP TAP. Your session has expired.

Rememberyou can file early then pay any amount you owe by this years due date. Schedule payments up to a year in advance. When the employee calculates his income taxes for the year the amount of taxes withheld helps determine whether a refund is issued to the taxpayer more was withheld than necessary or whether the taxpayer owes more.

Keep Your Creative Small Business Organized With Our Printable Tax Worksheets Includes Income Tr Small Business Tax Entrepreneur Taxes Business Tax Deductions

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Utah State Tax Benefits Information

Which Is Best Health Insurance Policy For Income Tax Saving In India Cheap Car Insurance Quotes Compare Quotes Insurance Quotes

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utah Income Taxes Utah State Tax Commission

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time Etsy Shop Critique Tax Time Spreadsheet

2020 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Utah Paycheck Calculator Smartasset Credit Card Offers Personal Loans Credit Card Approval

Utah State Tax Benefits Information