nfa tax stamp trust vs individual

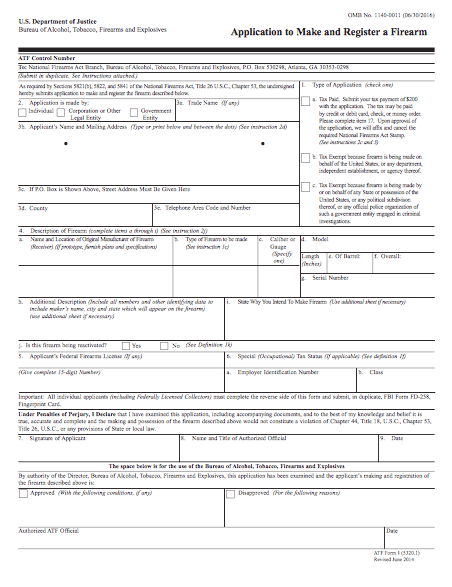

Box 3a should contain your name exactly as it appears on the current individual tax stamp and your current mailing address. Most people choose an NFA Gun Trust in order to make estate planning easier so that close family and friends can be allowed to take possession and use the suppressor or other NFA items.

How To Buy A Silencer Using A Nfa Gun Trust U Nationalguntrusts

Yes you can transfer your individual tax stamp into a gun trust corporation or other legal entity.

. It will be transferred to the trust AFTER getting the tax stamp. Individual Registration vs. If its a new trust and it does not own any NFA items yet just submit an empty Schedule A.

I was agreeing that for the two form types to be at pace with one another more filings would have to be reviewed and processed to catch up to the amount of individual forms. The depression was still running rampant many people were out of work and the economy was a mess. Just called ATF 304-616-4500 and got it all explained.

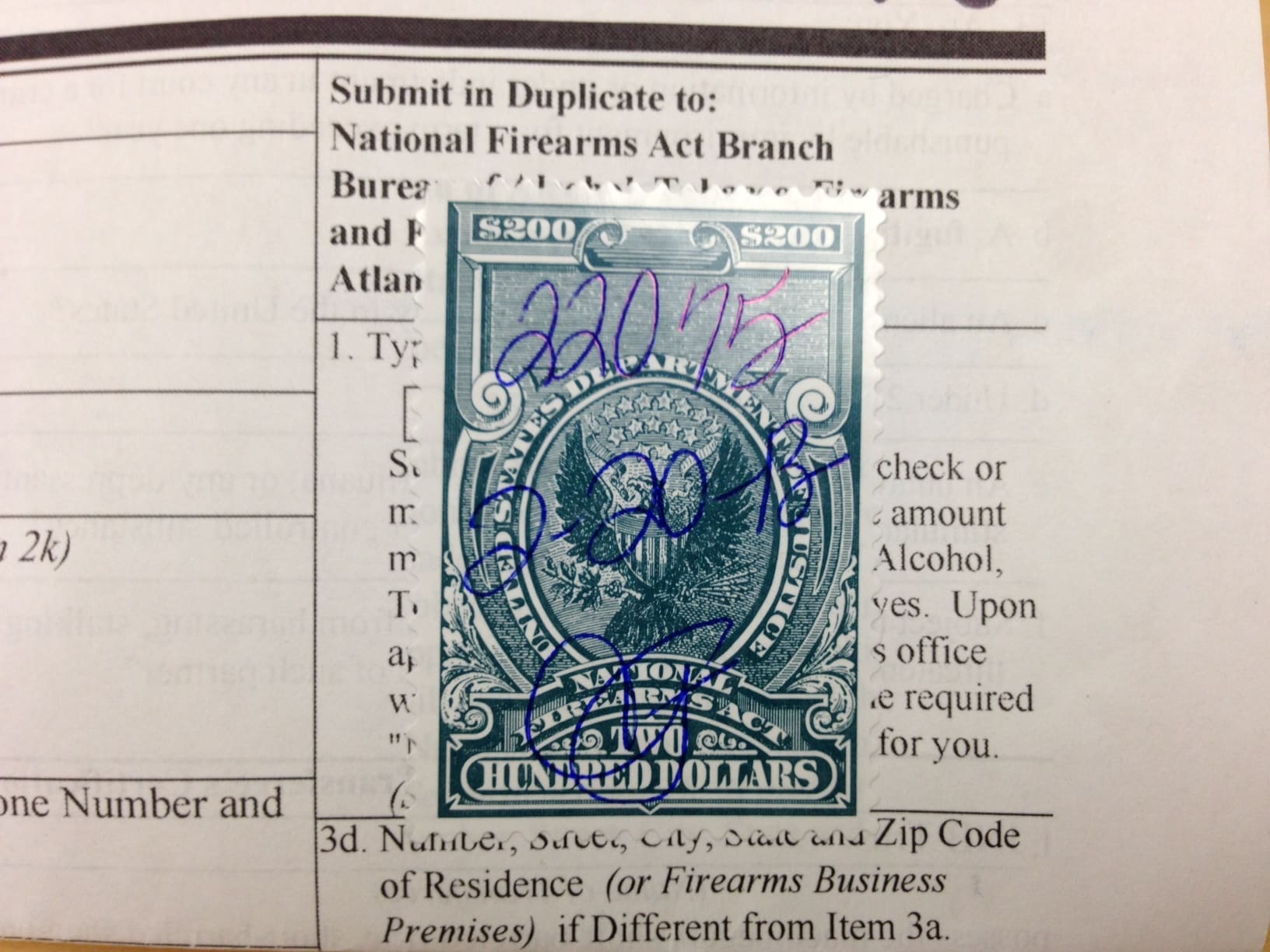

Online wholesaler individual or other gun trust. One DOES NOT list on Schedule A a firearm or receiver that is intended to be converted into SBR. In most cases the Tax Stamp is 200 but if you purchase an AOW the Tax Stamp is only 5.

The original fee for an NFA tax stamp in 1934 was 200. Individual Purchase What is a trust. That wait difference is about two weeks not including difference in time to cash the check which is 5days.

Trustees can handle the item which is still owned by the grantor by virtue of using a fully revocable trust. Surprisingly the tax has never increased. If you check out NFA Trackerright now the 3 month average for F4 Individualis 193 days 65 monthsand F4 Trustis 209 days 7 monthsfor the pending to approval time 200 check cashed to approved F4.

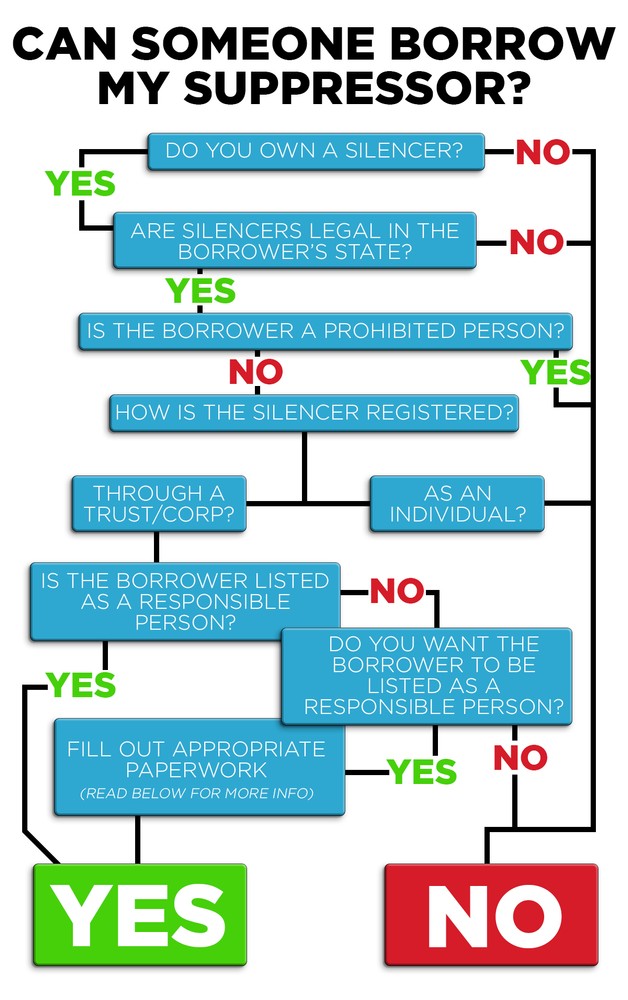

NFA Gun Trust At this stage you have to decide if you are going to register your suppressor as an individual or in the name of a trust. You can still use the NFA firearm while the 6 to 11 month approval. But keep in mind if you buy your Silencer or SBR from an out of state retailer you will need to have it shipped to a gun store that is located in.

There is no discount or change in the Tax Stamp for a Trust. If my dad is on my trust i dont need to be present for him to use the can. Not gonna lie though wait times for individual are far better.

A trust just gives more options. That doesnt seem like much now but in 1934 that was a huge sum of money to most people. Boxes 4a through 4h should be copied directly from the current individual tax stamp.

2-qllowing other people to use your nfa item. Use a revocable trust so that youre not transferring the NFA item. A trust is far superior to individual ownership of NFA firearms for several reasons.

However since you are transferring the NFA firearm from one entity yourself to a different entity your gun trust corporation or other legal entity you will need to pay the ATF the 200 tax stamp again. Box 3b should contain your email address. The ratio of trust to individuals would be different.

It requires some simple legal paperwork that you can have your local lawyer draw up for you or you can use an online Trust-building resource. Yes The Tax Stamp is for the ability to transfer a Title II firearms to an individual business entity or trust. At the time of this writing individual Form 4s are transferring a couple of months faster than for trusts.

Box 3d and 3e should usually be left blank. It is illegal to possess an NFA firearm that is not registered to you. Sharing an individually owned NFA firearm is more problematic.

A trust is a legal entity that can make it simpler for your family members business employees or shooting buddies to also enjoy NFA items. Create your NFA Gun Trust. In fact you can buy NFA Firearms just about anywhere.

The tax represented by the stamp is still 200. Say that on June 15th 2016- there were 200 trusts filings and 70 individual filings. The 10 Steps required for getting your Tax Stamp are.

Box 3c should contain your telephone number. 1 avoid fingerprints photos and CLEO approval 2 all trustees of the trust can possess the NFA firearms. This is likely due to the internal division of labor in the ATF and the fact that most NFA items transfer on trusts.

In other words the examiners handling applications for individuals probably have a shorter workload. He can take it hunting or shooting without me and vice versa. With 41-F in full swing and now that the ATF has caught up on ATF Form 1 and ATF Form 4 submissions with Post-41F laws you may be looking at purchasing NFA.

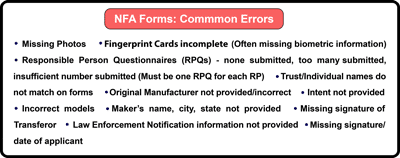

The requirement of a tax stamp is triggered by a transfer Be careful because ATF treats foot-faults in compliance as if they were crimes.

Nfa Tax Stamp How To Get A Suppressor Or Sbr Tax Stamp 2022 Rocketffl

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

How To Get A Suppressor Tax Stamp

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

Gun Trusts 14 Points Why A Gun Trust Is The Best Way To Get Your Nfa Item

A Buyer S Guide Individual Vs Trust

A Buyer S Guide Individual Vs Trust

Two Years After 41f Are Gun Trusts Still Worth It Nfa Gun Trusts

Ultimate Guide On What Is An Nfa Tax Stamp And How To Fill The Atf Eform 1 For Nfa Tax Stamp Application F5 Mfg F5 Manufacturing

Is An Nfa Trust Still Worth It The Truth About Guns

Atf Form 1 Guide Updated For 2021 Ffl License

How To Buy A Suppressor Using An Nfa Trust The Truth About Guns

Why Have A Gun Trust Estate Planning Lawyers In Sarasota Fl Manasota Elder Law

How To Fill Out Atf Form 1 Form Filling Employer Identification Number

Why Choose A Nfa Gun Trust Instead Of Filing Individually For Your Atf National Gun Trusts

5 Steps To Getting Your Atf Approved Nfa Tax Stamp With A Nfa Gun Trus National Gun Trusts